We know that this is a really challenging time for businesses so we’ve gathered together some information specifically about funding and financial help for businesses such as loans, latest grant schemes launched, funding and financial support schemes. We’ve also rounded up some of our favourite free (and cheap) online resources that might be useful for you if you run a business.

We will continually update this page as new schemes and announcements are made, however, if you have some information which you think we should include, please get in touch with us at [email protected].

Funding, Grants and Loans

High Peak Borough Council – Discretionary business grant scheme

Launched on 2nd June, small businesses experiencing a significant drop in income as a result of Covid-19 can now apply to High Peak Borough Council for a Discretionary Business Grant Fund.

This fund is aimed at businesses that fell outside the scope of the previous grants for small businesses and those in retail, hospitality and leisure. It is for small businesses with ongoing fixed property related costs. Funding awards are at the discretion of the Council with the maximum grant likely to be £10,000.

For more information go to: highpeak.gov.uk/article/4933/Discretionary-business-grant-scheme-launched. The link in the article to apply does not appear to work but you can apply here.

New funding to support dairy farmers

A new dairy response fund will open for applications on 18th June, Farming Minister Victoria Prentis confirmed on 3rd June.

With some dairy farmers facing financial difficulties and excess milk due to the coronavirus outbreak, the new fund will provide up to £10,000 each to help those dairy farmers most in need of support to sustain their business.

gov.uk/government/news/dairy-response-fund-set-to-open-for-applications

The Prince’s Trust and NatWest Enterprise Relief Fund

The £5million Enterprise Relief Fund will offer grants to 18 to 30-year olds across the UK who are self-employed and/or running their own business. In conjunction with cash grants, the initiative will offer one-to-one support and guidance to anyone who needs it and who may be worried about their future.

princes-trust.org.uk/about-the-trust/coronavirus-response/enterprise-relief-fund

Facebook Small Business Grants

Facebook’s Small Business Grants program will give more than $100 million to 30,000 small businesses across the globe. Applications began to roll out on 21st April and applications open in different countries at different times. You can read more about the scheme and the types of businesses eligible by clicking the link below. Applications for the United Kingdom have not yet opened but you can register your interest by clicking the button ‘See eligible areas and apply’. The programme says it will offer both cash grants and Facebook ad credits so if you run a small business, it’s definitely worth looking at.

facebook.com/business/boost/grants

Google Meet – Premium Video Meetings

Google Meet is now free and individuals can currently host secure video meetings for up to 1 hour with up to 100 participants. Read more: apps.google.com/intl/en-GB/meet

Mailchimp

Mailchimp are offering existing, small business customers credit on their accounts. Current customers who have 25 or fewer employees in categories including restaurants and hospitality; brick and mortar retail; travel and leisure; entertainment; health, beauty, and wellness; and other select businesses are eligible for this price relief. You need to log in to your account and a notification may appear to claim your free credit, or, you contact their support team to find out more.

mailchimp.com/covid19-small-business-support-fund

Google Ad Credits

Google are offering small and medium size businesses ad credits, which can be used towards future ad spend, until the end of 2020 across our Google Ads platforms. The scheme is open to existing customers who have who have spent with a Google Ads account in ten out of twelve months of 2019, and in January and/or February of this year.

There is no application process and no action to take. Once the ad credits are launched they are automatically applied to Google Ads accounts per the above eligibility criteria. Ad credits will be automatically be applied to eligible Google Ads accounts.

Small Business Grants Fund (SBGF) and Retail, Hospitality and Leisure Grant Fund (RHLGF).

You will need to apply for these two grants via your local authority.

- Available to all businesses in receipt of Small Business Rate Relief (SBRR) and Rural Rates Relief (RRR). Businesses must have been in receipt of SBRR or RRR on the 11th March 2020 and only one grant per hereditament is available. Eligible businesses will qualify for a grant payment of £10,000.

- Retail, Hospitality and Leisure Grant Fund – available to businesses who are eligible for the Expanded Retail Discount (which covers retail, hospitality and leisure) with a rateable value (RV) of less than £51,000. Businesses must have been eligible for a discount under the Business Rates Expended Retail Discount Scheme on the 11th March 2020 (had the scheme been in force at that point) and only one grant per hereditament is available. Eligible businesses will qualify for a grant payment of:

£10,000 (for businesses with a rateable value of up to £15,000)

£25,000 (for businesses with a rateable value of over £15,000 and less than £51,000)

For more information and to apply, go to: highpeak.gov.uk/Coronavirus-Business-Financial-Support

Bounce Back Loan Scheme for Small Businesses

A new ‘bounce-back’ loan scheme was announced by the Chancellor Rishi Sunak (27th April). Small businesses will benefit from a new fast-track finance scheme providing loans with a 100% government-backed guarantee for lenders.

The Bounce Back Loan scheme will help small and medium-sized businesses to borrow between £2,000 and £50,000.

Find out more and how to apply here: gov.uk/guidance/apply-for-a-coronavirus-bounce-back-loan

Coronavirus Business Interruption Loan Scheme (CBILS)

This scheme helps small and medium-sized businesses to access loans and other kinds of finance up to £5 million. The government guarantees 80% of the finance to the lender and pays interest and any fees for the first 12 months. Read more on the gov.uk website here or you can use the link below to find a lender and apply:

Coronavirus Future Fund

The Future Fund provides government loans to UK-based companies ranging from £125,000 to £5 million, subject to at least equal match funding from private investors.

These convertible loans may be an option for businesses that rely on equity investment and are unable to access other government business support programmes because they are either pre-revenue or pre-profit.

The scheme is open for applications until the end of September 2020.

Coronavirus Job Retention Scheme: financial help for business owners and employees (furloughing)

Claim for 80% of your employee’s wages plus any employer National Insurance and pension contributions, if you have put them on furlough because of coronavirus (COVID-19).

The Coronavirus Job Retention Scheme has been extended to the end of October and some of the details have also been updated and changed. From 1st July, employers can bring back to work employees that have previously been furloughed for any amount of time and any shift pattern, while still being able to claim the Coronavirus Job Retention Scheme grant for their normal hours not worked. The scheme will close to new entrants from 30th June.

gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

Self Employment Income Support Scheme

The coronavirus (COVID-19) Self Employment Income Support Scheme provides financial help during the current crisis for those who are self employed.

The Chancellor announced on 29th May that the scheme is being extended. You’ll be able to make a claim for a second and final grant in August 2020.

The package covers 80% of their average monthly profits to help them cope with the financial impact of coronavirus and key features include:

- The scheme will be open to those with a trading profit of less than £50,000 in 2018-19 or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

- More than half of their income in these periods must come from self-employment.

- To try and combat fraud, only those who are already in self-employment will be eligible to apply.

- Applicants will also be required to prove they have lost income due to coronavirus via an online declaration form.

Read the full guidance, check if you are eligible and how to apply for this scheme in detail here: gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme

Other financial support

Business rate holiday

Businesses in the retail, hospitality and leisure sectors in England will not have to pay business rates for the 2020 to 2021 tax year.

You do not need to take any action. Your local council will apply the discount automatically.

Self Assessment Payment Deferral

Self assessment payments on account due on 31 July 2020 will now not need to be made until 31 January 2021. The deferral for income tax self assessment applies to the second payment on account for 2019/20 due on 31 July 2020 which is deferred until 31 January 2021. This is an automatic offer and no application is required.

gov.uk/guidance/defer-your-self-assessment-payment-on-account-due-to-coronavirus-covid-19

VAT payment deferral

Temporary changes have been made to the VAT payments due between 20th March 2020 and 30th June 2020 to help businesses manage their cash flow.

If you’re a UK VAT registered business and have a VAT payment due between 20 March 2020 and 30 June 2020, you have the option to:

- defer the payment until a later date

- pay the VAT due as normal

HMRC will not charge interest or penalties on any amount deferred as a result of the Chancellor’s announcement.

gov.uk/guidance/deferral-of-vat-payments-due-to-coronavirus-covid-19

Other really useful free (and cheap) resources we love!

There are some superb free resources online that are especially useful for business owners, so here’s our pick a few our favourite online tools that might come in handy:

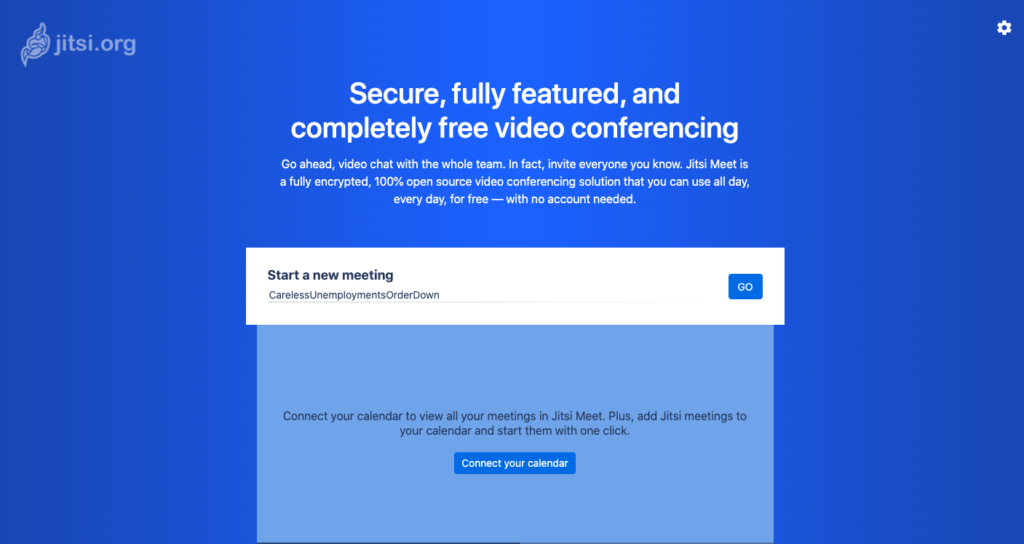

Jitsi – video conferencing

Jitsi is really easy to use and no-signing up is required if you use it on desktop. If you use it on a tablet or smartphone you’ll need to download the app. There is no time limit to your video call either (unlike the free version of Zoom) and you can host up to 75 people in one call. You can also lock a room with a password if you prefer for added security. Worked perfectly the times we’ve used it.

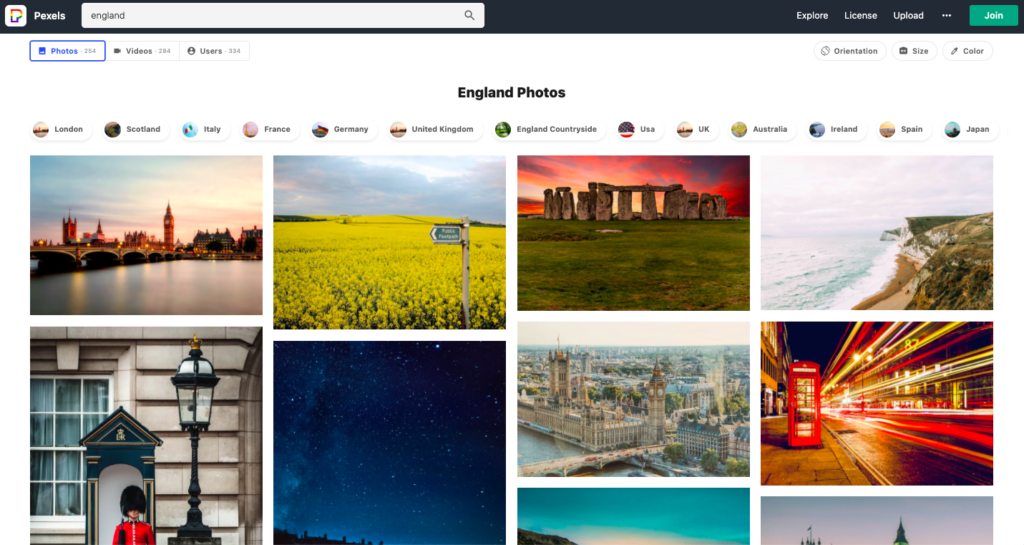

Pexels – free stock images

If you’re looking for great quality images for either a blog, website or design work, Pexels is perfect for the job and absolutely free. The images are high resolution and anyone can contribute and there are 1000s to choose from. When you search for an image, related images appear below your result too which is really handy. Another favourite of ours is Unsplash; again anyone can contribute.

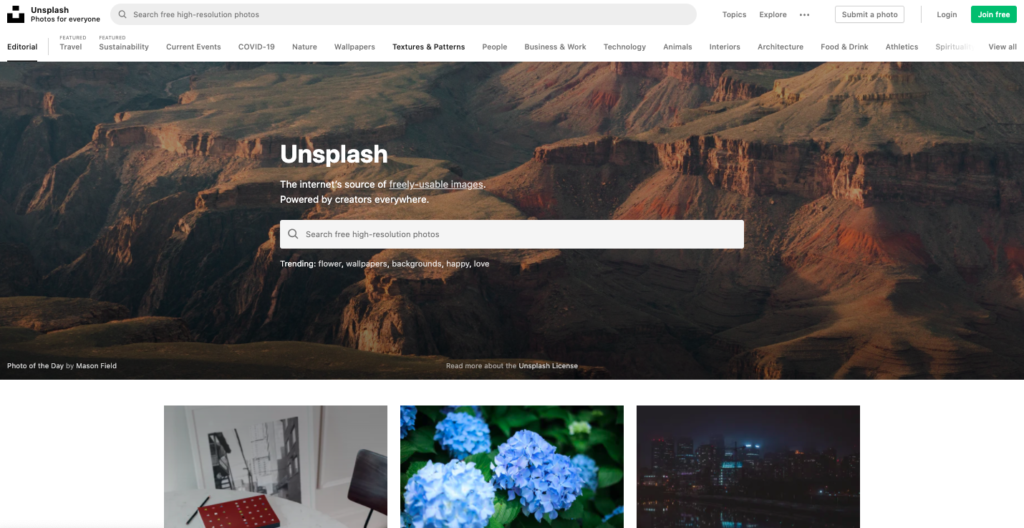

Unsplash – free stock images

Unsplash does has more of a ‘photography’ feel to it and you might find less results when searching for something specific – here though you can find some great landscape and travel photos which we love, again completely free and really easy to use.

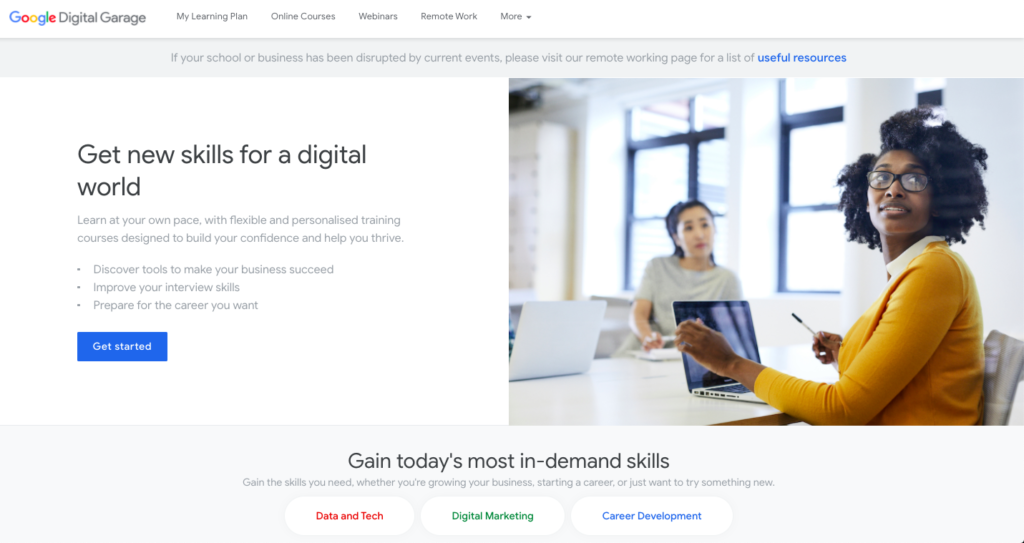

Free online training with Google Digital Garage

From writing a CV and cover letter, writing a digital marketing strategy to productivity for working remotely, how to use Google Analytics and more, Google’s Digital Garage offers some great free webinars with many geared towards improving your digital skills. The sessions are timed and many last for 1 hour and are completely free. All you need to do to watch a webinar is register with your basic details. Google Digital Garage is a superb online resource with a plethora of information across the site, where you can also take more in-depth online courses and again they’re free.

learndigital.withgoogle.com/digitalgarage

Canva – online design tool

Canva, the online design tool that makes design work feel so easy, stress free and actually really fun to use. Photoshop for example is great we know but there’s alot to it and it can be complicated, especially for people who’ve never used it before. Canva solves this nicely; there are 100s of ready made templates to choose from and you can add your own brand colours, upload your own images and use your own fonts on your designs. Everything in online and saved automatically in your dashboard. There are templates that are sized specifically for social media use for example, such as Facebook posts, tweets and more – which is so handy! You can try it out free for 30 days and then pay as you go for £10.99 a month and cancel at any time – and yes it’s easy to cancel so if you just need it for a short time, bingo. We love it, as you can probably tell 🤓

Google Docs, Sheets, Slides…an alternative to MS Office

This free web based software by Google works in the same way as MS Office and almost all of the commands are the same place in terms of where everything is. It’s better in some ways because this is all online and everything is saved automatically after any changes. You’ll need to create a Gmail email account (which is free) and you’re off. You can find everything in the top right hand corner where you can see nine little dots – just in case you’re new to this. Also, you can edit documents with others at the same time which is really handy if more than one person is working on the same project/list etc. There’s a useful template gallery in Docs too. This system is perfect if you’re looking for a free alternative to MS Office.

Wave – online accounting software

Accounting and invoicing software online and it’s completely free. If you need to create professional looking invoices for your business and keep track of expenses then Wave does this for you. You can set it up so you can accept card payments too – managed by well known payment platform Stripe. You can set the system to automatically send reminders to customers and the way the dashboard is organised, you can easily visualise what’s outstanding and what’s overdue etc. The system is simple and not as heavy duty as say the other big online accounting favourite Zero (which isn’t free) but if you’re after something that won’t cost you anything, this is a great start.

Business support organisations

Marketing Peak District & Derbyshire

Marketing Peak District & Derbyshire is the industry arm of the regions official tourist board Visit Peak District & Derbyshire and this is a superb online resource for businesses, in particular those in the leisure, tourism and hospitality. Their Coronavirus Guidance & Support information page is updated regularly with their latest statement on the current situation as well a lots of information on the latest news about grants and funding, industry updates and their current programme of free webinars – funded by via their European Regional Development Fund project. The webinars are a superb resource and previous recordings can be found here if you miss one.

visitpeakdistrict.com/industry/business-support/useful-links/coronavirus-guidance-and-support

VisitBritain

VisitEngland have a huge range of information online including handy links to official government guidance as it is published and updates on the work Visit Britain are carrying out in response to the pandemic.

Government roadmap – when can businesses reopen?

From 1st June

- Outdoor markets and car showrooms opened

From 15th June

- All non-essential shops can reopen

From 4th July

- At least ‘some of the remaining business and premises that have been required to close, including personal care (such as hairdressers and beauty salons) hospitality (such as food service providers, pubs and accommodation), public places (such as places of worship) and leisure facilities (like cinemas). They should also meet the COVID-19 Secure guidelines.

At time time of writing, the tourism industry in the UK has still been given no confirmed date as when businesses can open such hotels, B&Bs, hostels, campsites, caravans, short terms holiday lets and self catering accommodation.

The following guidance was updated on 5th June and we will update this page with any further developments: gov.uk/guidance/covid-19-advice-for-accommodation-providers

Did You Enjoy This?

You might like our regular newsletter. We put all the best events, cultural highlights and offers from Buxton and the Peak District in your inbox every month.

This information will only be used to send you this newsletter. It is stored in Mailchimp.